Transforming Retail with Art: The Gentle Monster Experience

Hi! Welcome back to our series on marketing in China. Today, we’re exploring a fascinating trend that's reshaping the retail landscape: art installations in shops.

Have you ever wondered why stores like Gentle Monster in Shanghai draw massive crowds? It’s thanks to their focus on art installations. Art and commerce have become deeply intertwined in China, creating unique retail experiences that attract and engage consumers. This growing trend of incorporating art installations into retail spaces resonates with Chinese consumers, making shopping not just an activity but an experience.

Why Art Installations Work

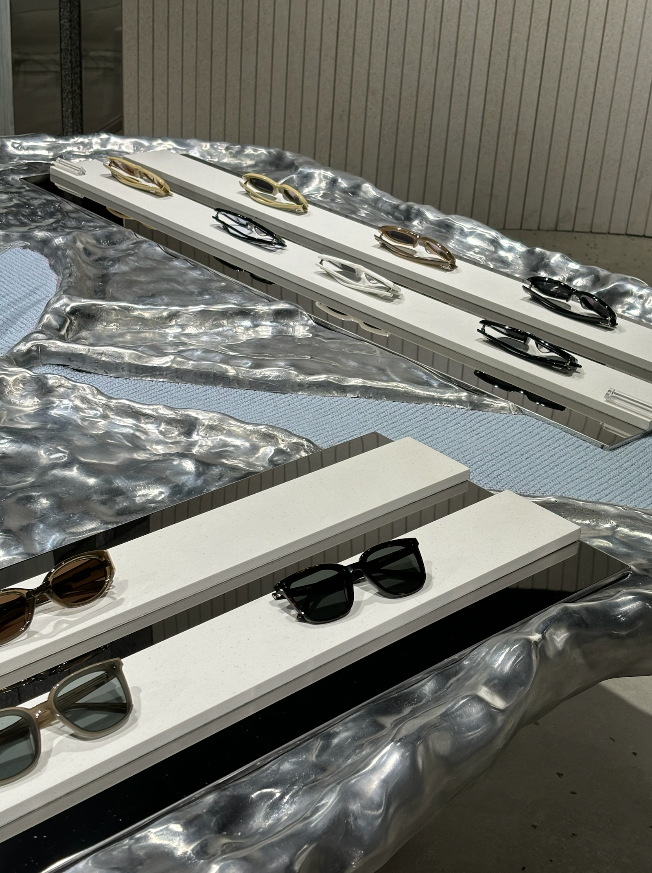

Gentle Monster, a South Korean eyewear brand, has taken retail to the next level with its Shanghai store called Haus Nowhere. The ground floor greets visitors with a pair of robot statues, leading them upstairs to even larger installations of two gigantic heads facing each other. These captivating displays not only showcase their products but also create an immersive experience for visitors.

This spring, the lines were 2 hours long just to get inside. Once in, visitors were greeted with visually stunning displays that had to be photographed and shared on social media, particularly on Xiaohongshu (RED). The installation of 2 very realistic human faces went viral, resulting in an explosion of user-generated content that boosted the brand's visibility and appeal.

In addition to eyewear, the store features Gentle Monster’s own café brand NUDAKE, presenting a “croissant gym” concept space. The ground floor also hosts the South Korean fragrance brand Tamburins, with a hyperreal statue of an elderly couple adding to the artistic atmosphere.

Gentle Monster dedicates the majority of square meter space to art and only around 20% to merchandising, it is clear that the brand prioritizes creating an experiential and art space. This approach aligns with the rapid post-pandemic development of social commerce, as brands become more creative in utilizing their physical retail spaces.

By creating an art experience within the shop, Gentle Monster has not only created a check-in place for visitors but also an on-brand display of the eyewear label’s arty image. The retail space provides high “emotional value” for young visitors with a need for experience and fashion.

Wrapping up, Art installations in retail spaces are not just a trend; they’re a powerful marketing tool that can transform the shopping experience and boost brand visibility.

At Think East, we specialize in helping brands develop innovative retail strategies that resonate with Chinese consumers. Whether it's creating engaging art installations or leveraging social media for maximum impact, our team can guide you in transforming your retail space into an unforgettable experience.

As you think about your own retail strategy, consider how you can incorporate art to create engaging, shareable moments for your customers. How would you consider building art into your retail experience? Would your customers be willing to stand in line for 2 hours to see an art installation in your store?

Stay tuned for our next post, and connect with us on LinkedIn or via email—we’d love to hear your thoughts and questions.

See you next time!

Banner Image Credit: Gentle Monster (gentlemonster.com);

All photos in the gallery by Amy Weng

Kunst trifft auf Retail: Gentle Monsters Erfolgsrezept

Hi! Willkommen zurück zu unserer Serie über Marketing in China. Heute erkunden wir einen faszinierenden Trend, der den Retail neu gestaltet: Kunstinstallationen in Geschäften.

Warum sind Läden wie Gentle Monster in Shanghai so erfolgreich und können Menschenmengen anziehen? Das liegt an ihrem Marketing Fokus mit Kunstinstallationen. Kunst und Retail sind in China eng miteinander verflochten und schaffen einzigartige Einkaufserlebnisse, die Konsumenten anziehen und begeistern. Dieser wachsende Trend, Kunstinstallationen in Verkaufsräume zu integrieren, spricht die chinesischen Konsumenten an und macht das Einkaufen zu einem Erlebnis.

Warum sind Kunstinstallationen so beliebt?

Gentle Monster, eine südkoreanische Brillenmarke, hat mit ihrem Laden im Haus Nowhere in Shanghai den Retail auf die nächste Stufe gehoben. Das Erdgeschoss begrüsst die Besucher mit zwei Roboterstatuen und führt sie nach oben zu noch grösseren Installationen von zwei riesigen Köpfen, die einander gegenüberstehen. Diese faszinierenden Displays präsentieren nicht nur ihre Produkte, sondern schaffen auch ein immersives Erlebnis für die Besucher.

Diesen Frühling waren die Warteschlangen 2 Stunden lang, nur um hineinzukommen. Einmal drin, wurden die Besucher mit visuell beeindruckenden Displays begrüsst, die fotografiert und in sozialen Medien, besonders auf Xiaohongshu (RED), geteilt werden mussten. Die Installation von zwei sehr realistischen menschlichen Gesichtern ging viral und führte zu einer Explosion von nutzergenerierten Inhalten, die die Sichtbarkeit und Attraktivität der Marke steigerten.

Neben Brillen präsentiert der Laden auch Gentle Monsters eigene Café-Marke NUDAKE und ein „Croissant-Gym“-Konzept. Das Erdgeschoss präsentiert auch die südkoreanische Duftmarke Tamburins mit einer hyperrealistischen Statue eines älteren Paares, die zur künstlerischen Atmosphäre beiträgt.

Gentle Monster widmet den Grossteil der Ladenfläche der Kunst und nur etwa 20% dem Verkauf! Das zeigt, dass die Marke auf die Schaffung eines Erlebnisraums setzt. Dieser Ansatz entspricht der schnellen post-pandemischen Entwicklung des Social Commerce, da Marken kreativer werden, ihre stationären Geschäfte zu nutzen.

Durch die Schaffung eines Kunsterlebnisses im Laden hat Gentle Monster nicht nur einen Ort geschaffen, an dem Besucher einchecken, sondern auch eine markengerechte Darstellung des künstlerischen Images der Brillenmarke. Der Verkaufsraum bietet einen hohen „emotionalen Wert“ für junge Besucher, die Erlebnisse suchen.

Zusammengefasst sind Kunstinstallationen in Verkaufsräumen nicht nur ein Trend, sondern ein starkes Marketing-Tool, das das Einkaufserlebnis verwandeln und die Sichtbarkeit der Marke steigern kann.

Bei Think East helfen wir Marken, innovative Retailstrategien zu entwickeln, die bei chinesischen Konsumenten Anklang finden. Ob es darum geht, fesselnde Kunstinstallationen zu schaffen oder soziale Medien für maximale Wirkung zu nutzen, unser Team kann Sie dabei unterstützen, Ihren Verkaufsraum in ein unvergessliches Erlebnis zu verwandeln.

Wie können Sie Kunst in Ihrer eigenen Retailstrategie integrieren, um ansprechende, teilbare Momente für Ihre Kunden zu schaffen? Würden Ihre Kunden bereit sein, zwei Stunden in der Schlange zu stehen, um eine Kunstinstallation in Ihrem Geschäft zu sehen?

Bleiben Sie dran für unseren nächsten Beitrag und verbinden Sie sich mit uns auf LinkedIn oder per E-Mail – wir würden gerne Ihre Gedanken und Fragen hören.

Bis zum nächsten Mal!