The Swiss Blueprint: A Case Study on XPENG's Calculated Entry into Europe

While the Chinese electric vehicle (EV) giant BYD is often the focus of European market analysis, a new competitor has already quietly entered the continent. XPENG, a technology-driven EV manufacturer, has identified Europe as the centre piece for its long-term global growth. Since 2021, XPENG has pursued European expansion. Switzerland, despite its small population, has emerged as one of XPENG’s earliest and most strategically symbolic European markets.

In this article I analyse XPENG’s European strategy through the specific lens of its Swiss market launch, leveraging corporate announcements, partnership disclosures, and industry analysis from 2024 to today. Moving beyond the rhetoric of “disruption,” I examine the practical, multidimensional drivers behind XPENGs expansion:

- Strategic Market Choice: Why Switzerland Became XPENG’s Most Recent Key Market

- XPENG’s Brand Strategy and Key Differentiators: Premium AI-driven EVs

- Supply Chain Considerations: Local Production in Austria, The Move That Changed Everything

- Swiss Go-To-Market Strategy: Distribution and Trust

- Future Considerations and Big Picture: XPENG’s European Future, Geopolitical Considerations

1. Strategic Market Choice: Why Switzerland Became XPENG’s Most Recent Key Market

XPENG kicked off its European expansion in 2021, entering markets with established EV adoption, such as Norway, Sweden, the Netherlands, and Denmark. The company deepened its continental presence in 2024 by launching in the key automotive hubs of Germany, France, the UK, and Italy.

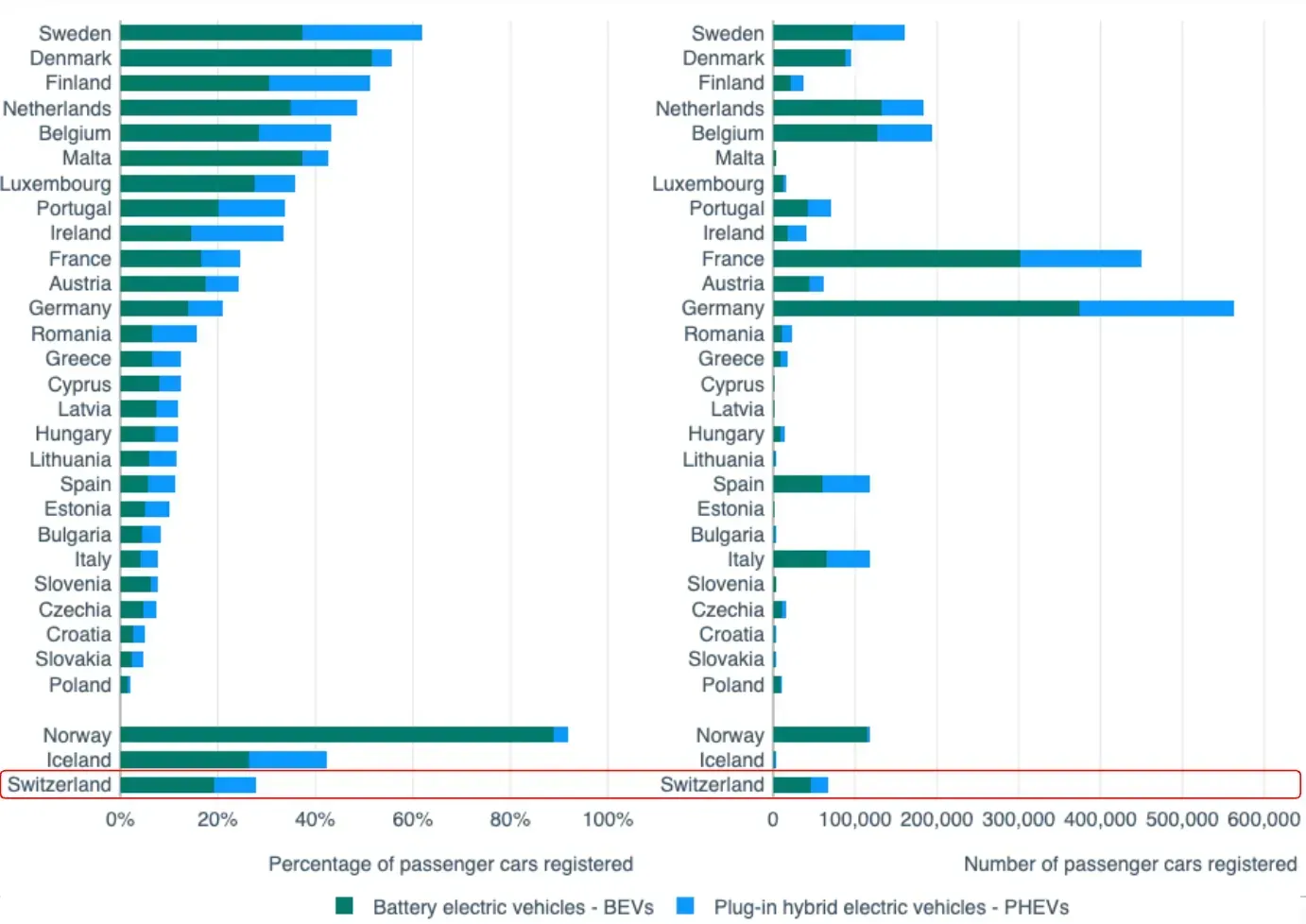

Now, as of late 2025, XPENGs strategy focuses on rapid European market expansion to achieve comprehensive European coverage. A significant new market in this phase is Switzerland. Unlike the Nordic nations, which are recognised leaders in EV adoption, Switzerland has a different market profile, characterised by high purchasing power but more moderate EV penetration (see Graph 1). This raises a key strategic question: why would XPENG prioritise Switzerland as an early and important market? Switzerland is a small country and not an EV-heaven like the Nordics (see Graph 1). So what makes Switzerland a strategic choice for XPENG?

My analysis suggests three primary factors that make Switzerland a strategically attractive entry point for XPENG:

High EV Adoption Rate: Switzerland is a logical next step in XPENG’s market expansion. As shown in Graph 1, the country has one of the highest electric vehicle adoption rates in Europe, following closely behind the Nordic markets where XPENG first established its European presence. By entering Switzerland, the company directly targets a large customer base that is already familiar with and receptive to electric mobility, reducing the need for extensive consumer education on EV technology.

Absence of a Domestic Auto Industry: Switzerland lacks a significant domestic car manufacturing sector compared to Germany or France, where XPENG is already active. Consequently, XPENG enters a market largely free from the protective industrial policies or legislative measures often designed to shield local automakers from international competition. This creates a more open and less politically complex competitive landscape.

Strong Purchasing Power and Premium Market Affinity: The Swiss market aligns well with XPENG’s premium positioning. Data indicates that Swiss consumers are accustomed to new car prices in the range of CHF 60,000 and above, which corresponds directly with XPENG’s pricing strategy. Furthermore, the market exhibits a strong and sustained preference for premium automotive brands, with BMW, Audi, and Mercedes-Benz consistently holding large market shares. This consumer behaviour toward high-value vehicles provides a favourable environment for XPENG to position itself as a technology-focused alternative within the premium segment.

Graph 1: Newly registered electric cars by country in 2024, provided by the European Environment Agency

2. XPENG’s Brand Strategy and Key Differentiators: Premium AI-driven EVs

Consistent with its positioning, XPENG has entered the Swiss market with a high-end-only portfolio. The brand is initially offering just three models; the flagship G9 SUV, the coupe-style G6 SUV, and the P7 sedan. This focused approach allows XPENG to concentrate its marketing and service resources on establishing a strong reputation for quality and advanced technology.

Below is a condensed overview of XPENGs product position in the Swiss market:

- Product Strategy: Technology-Led Differentiation and Targeted Portfolio: XPENG positions themselves with “smart EVs with advanced technology, performance, 800 V architecture, fast charging, and 5-star safety”. Each model was awarded the Euro NCAP 5-star safety rating. Their supercharging battery can be charged to 80% within 12 minutes. In comparison, Audis Q4 e-tron does not offer comparative fast charging capabilities and takes more than one hour to charge up to 80%. This significantly sets XPENG apart. Additionally, XPENG’s product mix (SUVs and sedan) covers multiple buyer segments and addresses families or SUV-oriented users (G9/G6), but also sedan buyers (P7).

- Price: Targeting the Premium Segment Amid Market Challenges: Consistent with its focus on advanced technology, XPENG has entered the Swiss market with a premium price point. Reported starting prices are CHF 59,990 for the G6 and P7 models, and CHF 71,500 for the flagship G9 SUV. This pricing tier, combined with its strategic partnership with the local distributor and retailer Hedin Mobility Group, signals a clear intent to compete in the mid-to-upper segment of the market rather. However, this relatively high sales price in Switzerland, given the high cost of living and the new 4% import duties for EVs since 2024, may limit XPENGs customer base. Recent global market data also shows that EV market share has stagnated.

- Distribution & Launch Strategy: A Partnership-Driven Approach: XPENG’s go-to-market strategy in Switzerland mitigates key market-entry risks through the partnership with the established importer and retailer Hedin Mobility Group. The launch leverages Hedin’s existing infrastructure, beginning with an anchor facility near Zurich, with plans to expand to 8–10 Swiss sales outlets by the end of 2025. After that, an expansion into even more European market is planned. This partnership provides XPENG with immediate access to a professional sales network, certified service and parts logistics, and local customer support, capabilities that would otherwise require years to develop. Critically, it also transfers the credibility and consumer trust associated with Hedin’s strong local reputation to the new brand.

- Promotion: Navigating the “Techno-Premium” Positioning and Trust Gap: XPENG’s promotional strategy positions it as a “techno-premium” alternative, differentiating itself by highlighting advanced AI technology, top-tier safety ratings, and design, while still leveraging the strong price-value ratio characteristic of Chinese EVs. This combination addresses a clear market shift; as an EY report notes, Chinese models’ share of European EV sales grew from 0.4% to 8% between 2019 and 2023. However, significant brand-building challenges remain. The same report indicates only 12% of European consumers have a Chinese EV brand in their top consideration, highlighting that XPENG must not only promote its features but also systematically build trust to convert interest into actual sales.

3. Supply Chain Considerations: Local Production in Austria, The Move That Changed Everything

One of the most important moments of XPENG’s European story is its 2025 decision to start local production at Magna Steyr in Austria, one of Europe’s most respected premium contract manufacturer. This strategic decision has the potential to influence consumer trust, given that the “Made in Europe” stamp could contribute to instant brand legitimacy.

But who is Magna Steyr? Magna Steyr is the contract manufacturing arm of the global automotive supplier Magna International, operating out of a plant in Graz, Austria. That plant is a long-established, multi-OEM contract manufacturing hub with specific expertise in electric vehicle production.

In the automotive industry, OEM (Original Equipment Manufacturer) refers to the brand that designs and markets the final vehicle, like XPENG. Companies like Magna Steyr are contract manufacturers that physically build cars for those OEMs. Therefore, when Magna assembles the G6 for XPENG in Austria, it is manufacturing a product for an OEM.

In the third quarter of 2025, Magna publicly announced it had been contracted to assemble XPENG’s European models, with serial production of the G6 and G9 SUVs starting shortly thereafter at the Graz facility. Industry reports confirm the first units have already rolled off this production line.

It’s important to clarify that Magna Steyr does not manufacture XPENG vehicles from scratch. Instead, the applied process is ‘Semi-Knocked Down’ (SKD) assembly. In this model, vehicles are built in XPENG’s Chinese factories, then partially disassembled into major modules for shipment. These modules are sent to the Graz plant, where Magna reassembles them into complete cars and performs final quality checks for the European market.

It should also be noted that the XPENG batteries are still fully produced in China. Public filings and reporting show XPENG sources cells and packs from major Chinese battery makers; notably CALB, EVE (EVE Energy), and BYD among others12.

XPENG’s primary motivation for local assembly in Austria is to overcome significant tariff barriers. By using Magna Steyr’s plant for Semi-Knocked-Down (SKD) assembly, its vehicles are classified as “Made in Europe.” This allows them to completely avoid the hefty 31.3% EU import surcharge on Chinese EVs and instead be subject to Switzerland’s standard automobile tax of approximately 4%, drastically improving their price competitiveness.

Beyond cost, this European footprint delivers crucial operational and strategic advantages. Final assembly in Graz shortens shipping times and enables faster spare parts availability compared to brands relying solely on China-Europe logistics. Furthermore, this production commitment is bolstered by XPENG’s new R&D center in Munich, which aims to tailor future vehicle innovations directly to European consumer preferences, signalling a long-term, integrated market strategy13.

4. Swiss Go-To-Market Strategy: Distribution and Trust

Let’s be clear: Switzerland will not be XPENG’s largest market by volume — but it’s a high-leverage market for credibility and premium positioning. Below I unpack why, the practical implications for distribution and pricing, as well as the risks and advantages:

- High purchasing power / wealthy consumers: Switzerland ranks among the world’s highest GDP-per-capita economies and has high household incomes and wages, which supports purchase of CHF-60k+ premium EVs.

- Average buyer expectations skew premium / quality-sensitive: Swiss consumers have historically bought premium European brands (VW, BMW, Mercedes and other imported brands lead registrations), showing a market orientation toward established quality perceptions rather than purely lowest-cost choices. That makes Switzerland a useful testing ground for premium positioning of a newcomer

- Relatively open to imports and early Chinese brand uptake: Recent DACH-region data and analysis show Switzerland has been an early adopter of BEVs relative to some neighbors and has tracked closely with Austria on Chinese brand registrations — meaning Swiss buyers are already receptive to new entrants, including Chinese EV brands. That creates a lower-friction channel for building word-of-mouth across German-language markets.

- Market size is small but influential: Switzerland’s auto market is small in absolute units, but Swiss buyers are often regarded as trend-sensitive for premium mobility (high per-capita spending, dense media coverage in DACH mobility press), so favorable Swiss reception can help credibly transfer to neighbouring German-speaking markets. Recent market reporting highlights how Swiss BEV adoption and model wins are picked up by regional auto press.

5. Future Considerations and Big Picture: XPENG’s European Future, Geopolitical Considerations

XPENG’s Euro-strategy is entering a decisive phase. Europe is simultaneously the most attractive and most politically volatile global EV battleground. XPENG must navigate a shifting mix of regulatory tightening, geopolitical friction, and fierce competition from both Chinese and European OEMs. The next five years will determine whether XPENG becomes a mainstream premium brand in Europe — or remains a tech-forward niche player.

Firstly, European regulatory tightening and trade barriers will significantly shape XPENG’s economics. Even though XPENG can evade sizeable import tariffs thanks to their production partnership with Magna, local content requirements and battery passport rules will tighten XPENG’s supply chains. Furthermore, data and cybersecurity rules (especially for connected vehicles) will require Europe-specific software governance, further challenging XPENG’s position.

Second, European customers value local presence. XPENG must therefore “Europeanize” faster. The cooperation with Magna Steyr using the SKD process will not suffice in the long run. If XPENG wants to increase customer buy-in, it will need to move toward “In Europe, For Europe.” Ultimately, XPENG’s “Europeanization” must evolve from a cost-driven production tactic into a core brand pillar, embedding European innovation and sourcing into the very identity of its vehicles to foster authentic customer loyalty and acceptance.

Photo 1: Official photo from XPENG, G7 model

This also leads directly into point three below:

Third, the European automotive supply chain has profound dependencies on non-EU battery, electronics, and raw-material suppliers. XPENG faces two structural risks:

- EU diversification pressure may push regulators to limit Chinese battery components.

- Geopolitical tensions could trigger export controls on critical technologies or materials.

XPENG can take a pioneer position in e.g, establishing alternative European or joint-venture battery partners. This will allow them to evade potential future protectionist tariffs, and also establish themselves as a key partner to the European car economy.

In Conclusion: A Strategic Foothold, A Challenging Ascent

XPENG’s entry into Switzerland serves as a prime example in market entry, demonstrating a blend of strategic positioning and tactical partnerships. By selecting a high-value market with strong EV adoption and no domestic industry protection, XPENG de-risked its European launch. Its strategy is built on clear differentiators: a “smart EV” technological edge, a premium brand posture, and the foundational partnership with Magna Steyr for local assembly, a move that simultaneously circumvents prohibitive tariffs and enhances supply chain agility.

However, establishing a foothold is only the first phase. XPENG’s long-term ambition to become a mainstream contender now depends on accelerating its transition from a savvy entrant to an integrated European partner. This requires moving beyond the current SKD model toward a deeper “In Europe, For Europe” industrial footprint. The critical next step is to address the continent’s most pressing strategic vulnerability: its battery supply chain.

Therefore, I recommend XPENG make a decisive, forward-looking investment in Europe’s battery ecosystem, for example, through a joint venture or by localising battery pack production. This would not merely mitigate future regulatory and geopolitical risks; it would fundamentally reposition XPENG. By directly contributing to European industrial resilience and clean-tech sovereignty, XPENG can transform its narrative from external competitor to invested local partner. This is the essential strategic evolution required to overcome the brand trust barrier and secure a lasting, sustainable position in the European automotive landscape.

Thank you for reading. I hope this analysis provides a clear framework for understanding the strategic challenges and opportunities ahead for XPENG and other new EV manufacturers in Europe.

Fiona Koh writes about China’s global expansion and how Chinese brands scale in Europe’s small but strategic markets. She is a Schwarzman Scholar at Tsinghua University in Beijing, pursuing a Master’s in Global Affairs. Fiona is also one of Think East’s guest contributors this year. This article is republished with permission. Follow Fiona’s writing on Substack.